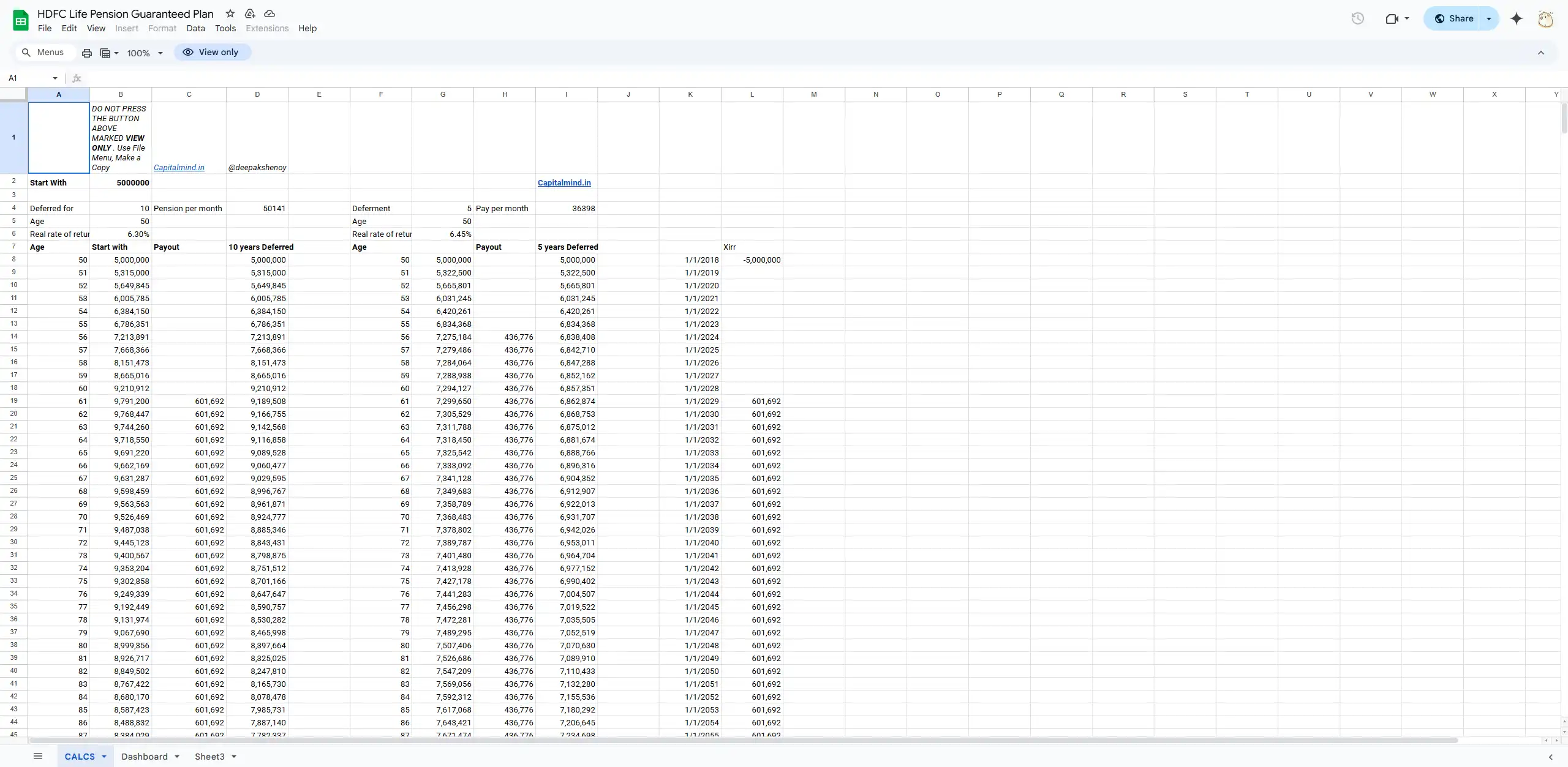

Overview:

The “HDFC Life Pension Guaranteed Plan” is a Google Sheets document that provides a detailed analysis of HDFC Life’s pension plan, including calculations for deferred and immediate annuity options. The document includes data on initial investment, annual payouts, and projected returns over time.

Target Audience:

This resource is intended for individuals considering retirement planning options, financial advisors, and professionals seeking to understand the specifics of HDFC Life’s pension products.

Usage Scenarios:

- Retirement Planning: Individuals can use the document to evaluate the potential returns and benefits of HDFC Life’s pension plan based on different investment amounts and deferment periods.

- Financial Advisory: Financial advisors can utilize the document to assist clients in making informed decisions regarding pension planning and investment strategies.

- Product Analysis: Professionals can analyze the plan’s features and performance metrics to compare with other pension products in the market.

Document Rating:

Considering its comprehensive analysis and practical utility, I rate this document 4.5 out of 5.

Key Points:

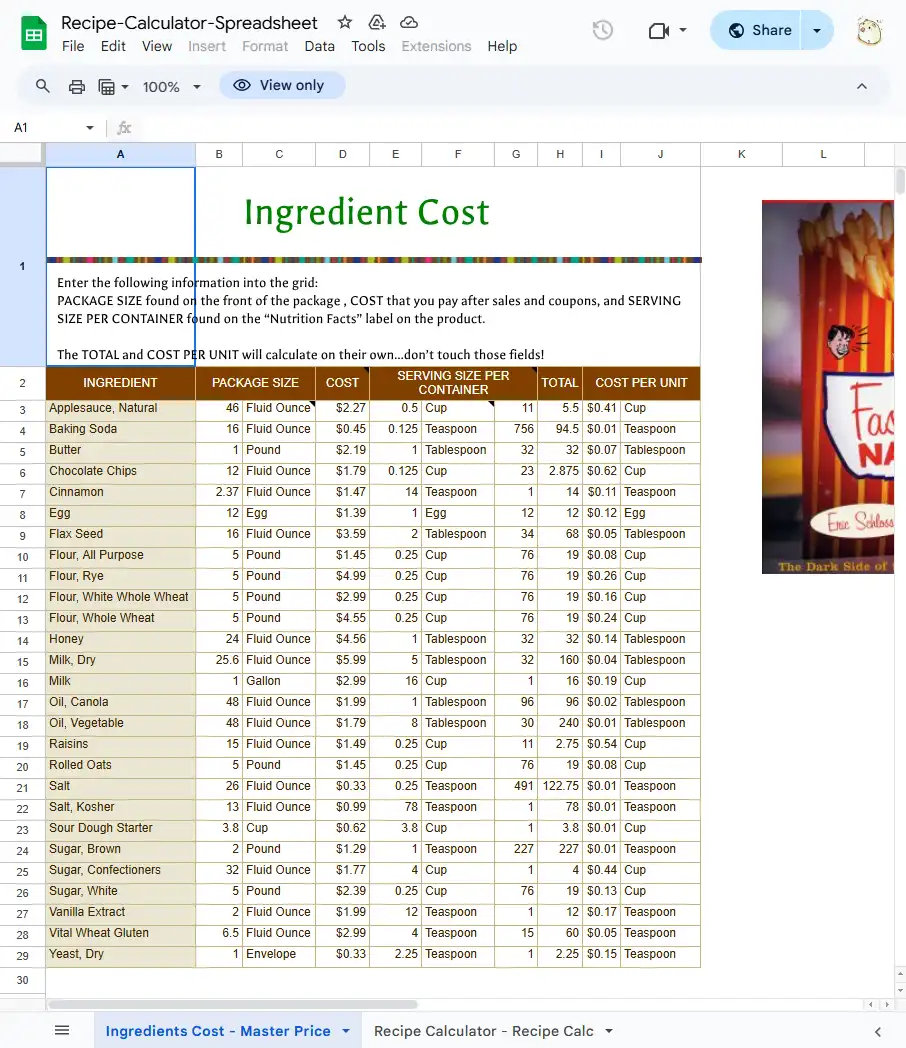

- Detailed Calculations: The document provides a thorough breakdown of investment amounts, annual payouts, and projected returns over time, facilitating a clear understanding of the plan’s benefits.

- Deferred and Immediate Options: It includes analyses for both deferred and immediate annuity options, allowing users to compare and choose based on their retirement timelines.

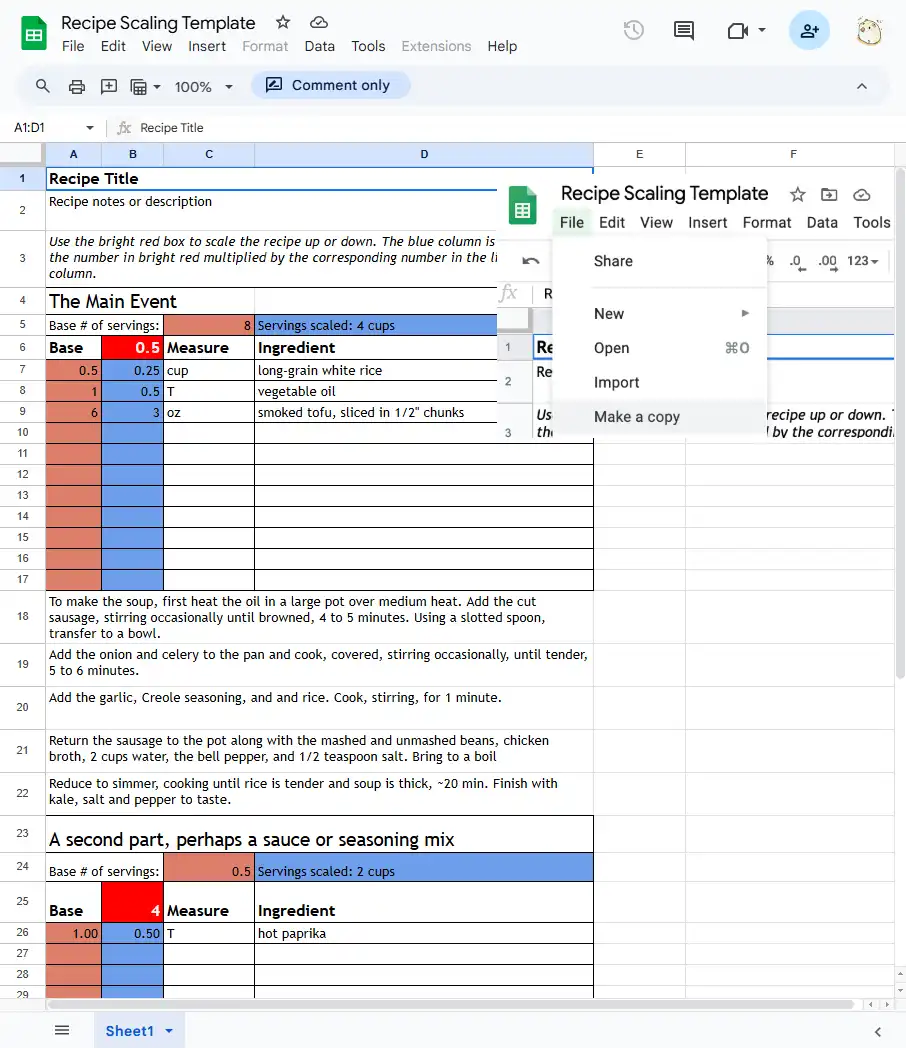

- User-Friendly Format: The spreadsheet format allows for easy navigation and customization, enabling users to input their own data to see personalized projections.

This document serves as a valuable tool for evaluating HDFC Life’s pension plan, offering organized and accessible information to facilitate informed decision-making regarding retirement planning.

Documents URL:

https://docs.google.com/spreadsheets/d/1vK3r-HZB7xz9V7XzE5-_xKaqO6cPlyPoqw6XipzQZP4/edit?usp=sharing

Copyright Notice:

This article is collected from internet information by Nami and manually written and organized. Unauthorized reproduction is prohibited.